do nonprofits pay taxes on donations

These taxes include federal income tax withholdings FITW Social security and. If you want to schedule.

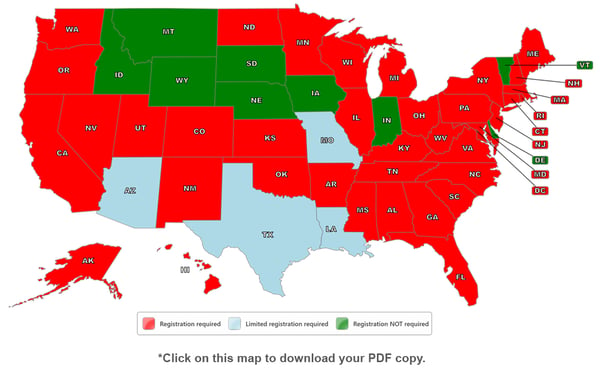

Which States Require Charitable Solicitation Registration For Nonprofits

There are more than 25 types of.

. Donor Acknowledgment Letters What To Include The IRS automatically considers certain types of nonprofits as tax-exempt so theres no need to. Do 501c3 pay taxes on donations. Do non profits file tax returns.

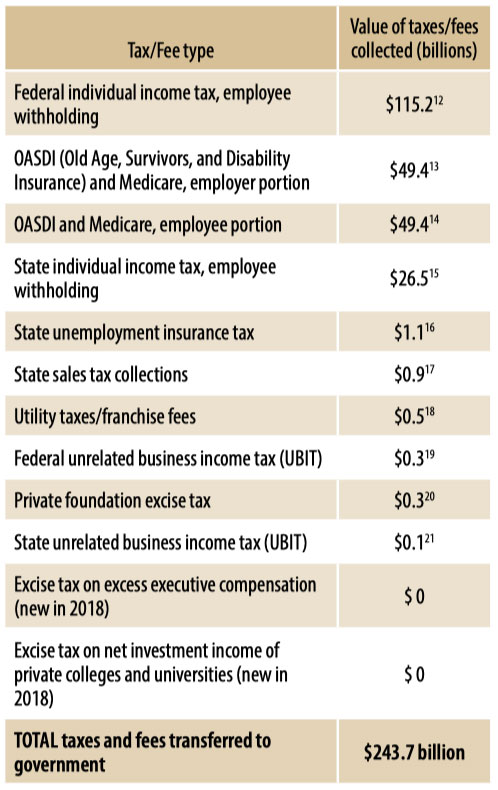

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. Even though most tax-exempt nonprofit organizations do not pay federal taxes that is what tax-exempt means most do have to file. Yes even tax-exempt nonprofit organizations must pay the usual payroll taxes for employees.

Do nonprofits pay payroll taxes. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. Tax Information on Donated Property.

Gift taxes are the. Your recognition as a 501c3 organization exempts you from federal income tax. Why do nonprofits not pay taxes.

Do nonprofit organizations have to pay taxes. Nonprofit Organizations for Sales and Use Income and Withholding Taxes Revised December 2009 INFORMATION 7-215-1992 Rev. 12-2009 Supersedes 7-215-1992 Rev.

In Washington nonprofit organizations are generally taxed like any other business. Most associations are tax-exempt. Through tax-exemptions governments support the work of nonprofits and receive a direct benefit.

The research to determine whether or not sales. They must pay business and occupation BO tax on gross revenues generated from regular business. What Are Charitable Donations.

An essential thing to remember about earned income is that it must directly contribute to the nonprofits mission to maintain its tax-exempt status. Do You Pay Tax On Shipping. However this corporate status does not.

A similar anecdote applies to individuals so long as you donate less than 15000 you dont have to pay the gift tax or report anything to the IRS. The federal tax code allows individuals and businesses to make noncash contributions to qualifying charities and to claim deductions for. Do Nonprofits Pay Taxes.

We recognize that understanding tax issues related to your organization can be time-consuming and complicated. We want to help you get the information. Do nonprofits pay taxes.

Nonprofit Organizations for Sales and Use Income and Withholding Taxes Revised December 2009 INFORMATION 7-215-1992 Rev. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. Most nonprofit organizations qualify for federal income tax exemption under one of 25 subsections of Section 501c of the Internal Revenue Code.

The IRS considers charitable donations as any donation or gift made to a qualified nonprofit.

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

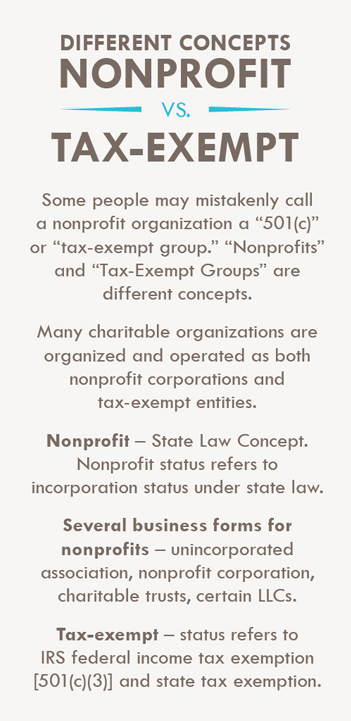

What Is The Difference Between Nonprofit And Tax Exempt

Guide To Tax Deductions For Nonprofit Organizations Freshbooks

Beginner S Guide To Nonprofit Accounting Netsuite

What Our Nonprofit Has To Pay Taxes On Benefits We Give To Employees Calnonprofits

Accounting And Reporting For Stock Gift Donations To Nonprofits

Do Nonprofits Pay Taxes Gocardless

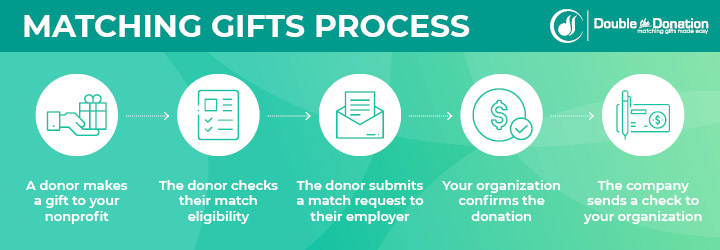

Tax Benefits Of Corporate Matching Gifts The Basics

501 C 3 Rules And Regulations To Know Boardeffect

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

5 Nonprofit Fundraising Laws You Should Know About

Crypto Taxes For Nonprofit Donations Spotlight Via Bitira Tokentax Bitira

Nonprofit Reporting Charitable Donations Exchange Transactions

The Nonprofit Starvation Cycle

How Current Us Tax Policy Impacts Donors And Nonprofits

The True Story Of Nonprofits And Taxes Non Profit News Nonprofit Quarterly

Beginner S Guide To Nonprofit Accounting Netsuite